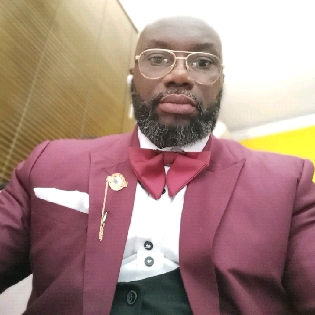

Lanre Lassise-Phillips currently serves as the Chairman Tax Appeal Tribunal Lagos Zone Panel 1. A position, he has held since 2018. In that capacity, he adjudicates, in conjunction with other members of the Tribunal, on all matters arising from the operations of federal taxes, including the Companies Income Tax, Petroleum Profit Tax, Personal Income Tax, Value Added Tax etc., between the taxpayers and tax authorities. He is responsible for writing the Judgments/Decisions of the Tribunal with input from the Tax Commissioners and presides over all Sittings and meetings of the Tribunal. He specialises in the fields of tax, banking, commercial, corporate secretarial and planning law. He is a partner in the firm.

Lanre Lassise-Phillips currently serves as the Chairman Tax Appeal Tribunal Lagos Zone Panel 1. A position, he has held since 2018. In that capacity, he adjudicates, in conjunction with other members of the Tribunal, on all matters arising from the operations of federal taxes, including the Companies Income Tax, Petroleum Profit Tax, Personal Income Tax, Value Added Tax etc., between the taxpayers and tax authorities. He is responsible for writing the Judgments/Decisions of the Tribunal with input from the Tax Commissioners and presides over all Sittings and meetings of the Tribunal. He specialises in the fields of tax, banking, commercial, corporate secretarial and planning law. He is a partner in the firm.

Between 2016 and 2018, he served as the regional head, South West of Skye Bank Plc providing leadership for the legal department, advising regional management on applicable banking laws, interfacing with regulatory agencies and generally managing the legal risks of the Bank. Generally, he provided legal guidance and advice on all transactions involving the Bank to ensure compliance with the regulations and laws governing banking business. He participated in the transitioning of the Skye Bank to Polaris Bank Limited. Later in 2018, he was recalled to the head office as bank’s Head of Litigation. He managed the litigation portfolio and continued to interface with regulatory agencies including the Economic & Financial Crimes Commission (EFCC) on behalf of the Bank. Still, in the same 2018, he was appointed a federal tax appeal commissioner.

Meanwhile, between 2012 and 2016, Lanre was the Practice Head of ASCO LP, a corporate tax law firm. He assisted in designing tax compliance structures for corporate and individual clients, providing opinions on vast issues affecting taxation in Nigeria particularly for foreign entities/individuals desiring to invest in Nigeria. Through powered networking, he liaised with relevant tax authorities to resolve client’s issues. He catered to the legal needs of diverse clients on diverse issues particularly in the financial sector.

Lanre has contributed significantly to the advancement of the fledging tax law practice in Nigeria. He is one of the editors of the African Tax Law Report, the Nigerian Revenue Law Reports as well as All Nigerian Tax Cases all of which are devoted exclusively to reporting tax cases.

Amongst others, he was a resource speaker at: an in-house tax training organised for Lagos State Internal Revenue Service [LIRS] on “Principles and Practice of Tax Appeal Under the Personal Income Tax Act” by Priory Terrace Solicitors 2015 tagged Legal Education & Research Node [LEARN]; Nungu Business School virtual training on the Innovations introduced by the new Companies and Allied Matters Act 2020; the HR Madam SME Clinic virtual training titled “Your Business & the Law” (a session for business owners & startups); the Centre for Law and Development Studies’ 2-day training on “Managing Transaction Taxes: Understanding Monthly Tax Compliance Requirement” June 2021; ESQ Practical Lawyers Academy Webinar titled “Tax Concerns of Foreign Persons investing in Nigeria” July 2021; the Civil Society Advocacy Centre (CISLAC) Sensitisation Workshop on Multiple Taxation and Judicial Redress Mechanisms titled “Overview of the Tax Appeal Tribunal (TAT) and Filing of Appeals at the TAT - Commencement to Conclusion” September 2021 amongst others.

He was an Associate Consultant for the Justice Research Institute (JRI) on “Building a Culture of Pro Bono in Lagos - Needs Assessment Study” 2014. Consultant to the Justice Research Institute (JRI) in respect of the Capital Punishment Survey [CPS] 2013. Resource Person to the Orderly Society Trust (OST) on the Freedom of Information Act. He was a Rapporteur, Bola Ahmed Tinubu Colloquium 2011 and he was the Consultant for the Justice Research Institute (JRI) on “Building a Culture of Pro Bono in Ogun State - Needs Assessment Study” 2020.

Lanre is also a consummate academic and has a number of publications online and in reputable law journals to his credit. His publications include: Commentary on the Review of the Court of Appeal Decision in Stabilini Visinoni Vs FBIR” published in Appellate Review Journal Vol.3 No.2.; “Tax Exemption granted under the Pioneer Status is never at Large” published online December 8, 2015, available at http://www.linkedin.com/pulse/tax-exemption-granted-under-pioneer-status-never-lassise-phillips/ ; “Gas Utilisation Project in Downstream Sector entitles the company to 35% Investment Allowance under CITA” published online December 2, 2015 available at http://www.linkedin.com/pulse/gas-utilisation-project-downstream-sector-entitles-35-lanre/; “Understanding the Knotty Issues in Tax Appeal in Nigeria – Part 4” published online December 1, 2015, available at http://www.linkedin.com/pulse/understanding -knotty-issues-tax-appeal-nigeria-lanre/; A Critical Evaluation of Tax Appeal Procedure Under the Personal Income Tax Act (as amended). He is the author of the book, Nigeria’s Tax Appeal System – The Law Practice & Procedure (in Press).

Lanre graduated from the distinguished University of Lagos with a Second-Class Upper Degree and he is pursuing a Doctoral programme in tax law from the same University having obtained his Master of Laws Degree. He holds an Advance Diploma in Theology. He also holds a National Diploma in Mass Communication from the Polytechnic Ibadan. He is an Associate of the Chartered Institute of Taxation of Nigeria (CITN), was a recipient of the Mobil Nigeria Unlimited National Merit Award and a University of Lagos Scholar.